Double Entry Bookkeeping Definition

Content

Double-entry bookkeeping is usually done using accounting software. The software lets a business create custom accounts, like a “technology expense” account to record purchases of computers, printers, cell phones, etc. You can also connect your business bank account to make recording transactions easier. You always list an increase in assets in the debit column and a decrease in assets in the credit column. If the total amount in your debit columns matches the total amount in your credit columns, your books are balanced. If the amounts don’t balance, there’s an accounting error somewhere in your records.

Using this system reduces errors and makes it easier to produce accurate financial statements. That’s a win because financial statements can help you make better decisions about what to spend money on in the future. Increase a liability or equity account, or decrease an asset account. Increase an asset account, or decrease a liability account or equity account (such as owner’s equity). In this case, assets (+$10,000 in inventory) and liabilities (+$10,000) are both affected. Both sides of the equation increase by $10,000, and the equation remains balanced. Accountants call this the accounting equation, and it’s the foundation of double-entry accounting.

Example of Double Entry

Although double-entry accounting does not prevent errors entirely, it limits the effect any errors have on the overall accounts. Shelley Elmblad is an expert in financial planning, personal finance software, and taxes, with experience researching and teaching savings strategies for over 20 years. And AuditorsAn auditor is a professional appointed by an enterprise for an independent analysis of their accounting records and financial statements. An auditor issues a report about the accuracy and reliability of financial statements based on the country’s local operating laws. Accounting EquationAccounting Equation is the primary accounting principle stating that a business’s total assets are equivalent to the sum of its liabilities & owner’s capital.

- With single entries, fraudulent activities become common, and tampering with the record is usual for companies.

- Is recorded in a minimum of two accounts, one is a debit account, and another is a credit account.

- There is a unique reporting structure, and, therefore, the records remain well-organized.

- If done correctly, your trial balance should show that the credit balance is the same as the debit balance.

- Credits will increase a liability account but decrease an asset account.

- In Example 4 given above, the liabilities of Lots of Fun Pty Ltd decrease by $1000 but its Bank Account also decreases by $1000.

- All small businesses with significant assets, liabilities or inventory.

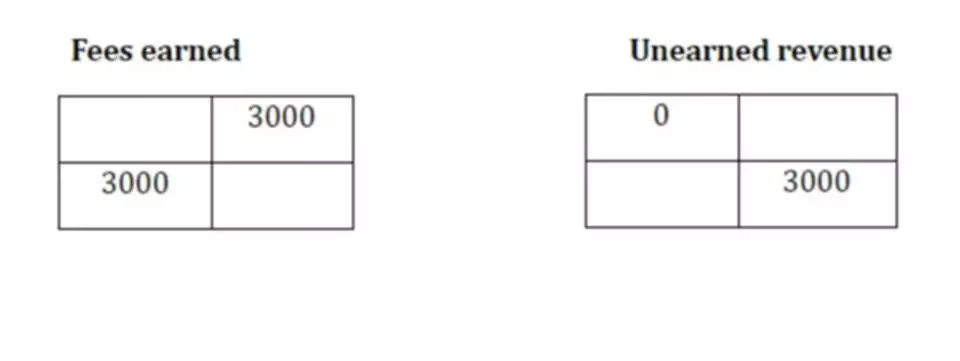

This principle is useful for identifying errors in the transaction recording process. You will learn about the accounting equation and double entry and the prepare for T-accounts. From the activities, you will get the opportunity to a) Prepare double-entry transactions and b) Prepare and record transactions in T-accounts.

Use accounting software

But our editorial integrity ensures our experts’ opinions aren’t influenced by compensation. If you want your business to be taken seriously—by investors, banks, potential buyers—you should be using double-entry. We believe everyone should be able to make financial decisions with confidence. To help Joe really understand how this works, Marilyn illustrates the double-entry double entry bookkeeping system with some sample transactions that Joe will likely encounter. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. He is the sole author of all the materials on AccountingCoach.com. Debit amounts will be entered on the left side of the T-account, and credit amounts will be entered on the right side.

Total assets must always equal total liabilities plus equity of a business. It is not used in daybooks , which normally do not form part of the nominal ledger system. The information from the daybooks will be used in the nominal ledger and it is the nominal ledgers that will ensure the integrity of the resulting financial information created from the daybooks .

How to Use Double-Entry Accounting

There are two columns in each account, with debit entries on the left and credit entries on the right. In double entry accounting, the total of all debit entries must match the total of all credit entries. A journal entry refers to the record you’ll make in your general ledger for every financial transaction. Some accounting software, like Xero and QuickBooks Online, automatically generate journal entries for your GL each time you accept a payment or pay a bill. Other software, such as Zoho Books’ free plan, requires you to make manual journal entries. If your credit entries don’t match your debit entries, you’ll likely need to identify the accounting error and then make an adjusting entry to bring your books back into balance.

System Of AccountingAccounting systems are used by organizations to record financial information such as income, expenses, and other accounting activities. They serve as a key tool for monitoring and tracking the company’s performance and ensuring the smooth operation of the firm. #2 – Personal Accounts –Debit the Receiver and Credit the Giver. The personal account includes the account of any person like an owner, debtor, creditor, etc.

From the activities, you can practice c)Transfer sales and sales return transactions from the daybooks to the general ledger, memorandum accounts, and receivables control account. You pay a credit card statement in the amount of $6,000, and all of the purchases are for expenses. The entry is a total of $6,000 debited https://www.bookstime.com/ to several expense accounts and $6,000 credited to the cash account. Thus, you are consuming an asset by paying for various expenses. Accounting software usually produces several different types of financial and accounting reports in addition to the balance sheet, income statement, and statement of cash flows.

Accounting SystemAccounting systems are used by organizations to record financial information such as income, expenses, and other accounting activities. The first case denotes a debit record and a corresponding credit, indicating a net effect, which comes to zero. Although three accounts were given effect in the second case, the net entry between debit and credit is 0. Hence, the double-entry system of accounting suggests that every debit should have a corresponding credit. A bookkeeper makes the same entry in two places to reflect two different transaction scenarios. To enter that transaction properly, you would need to debit your cash account, and credit your utilities expense account. While you can certainly create a chart of accounts manually, accounting software applications typically do this for you.

Who invented double-entry accounting?

Start with your existing cash balance for a given period, then add the income you receive and subtract your expenses. After you factor in all these transactions, at the end of the given period, you calculate the cash balance you are left with. This is reflected in the books by debiting inventory and crediting accounts payable. Every business transaction or accounting entry has to be recorded in at least two accounts in the books. The double-entry system began to propagate for practice in Italian merchant cities during the 14th century.

- Nominal AccountNominal Accounts are the general ledger accounts which are closed by the end of an accounting period.

- For businesses in the United States, the Financial Accounting Standards Board , is a non-governmental body.

- By having all this information to hand, companies are also better able to forecast future spending.

- The credit side is to the right, and the debit side is to the left.

- To illustrate how single-entry accounting works, say you pay $1,500 to attend a conference.

- These accounts ultimately filter down into your key financial reports.

Double-entry bookkeeping means that every transaction entered both debits and credits different nominal codes. This article shows the debit and credit entries for each transaction type. A simpler version of accounting is single entry accounting, which is essentially a cash basis system that is run from a check book. Under this approach, assets and liabilities are not formally tracked, which means that no balance sheet can be constructed. This approach can work well for a small business that cannot afford a full-time bookkeeper. A key reason for using double entry accounting is to be able to report assets, liabilities, and equity on the balance sheet.

You can dive in and find it before the issue blossoms into a financial crisis. The double-entry system requires a chart of accounts, which consists of all of the balance sheet and income statement accounts in which accountants make entries. A given company can add accounts and tailor them to more specifically reflect the company’s operations, accounting, and reporting needs. The accounting cycle begins with transactions and ends with completed financial statements. The journal is a chronological list of each accounting transaction and includes at a minimum the date, the accounts affected, and the amounts to be debited and credited.